Improving insurance business by implementing machine learning and artificial intelligence.

Fintech Company | 350 - 360 Employees

The insurance industry uses data of various types to calculate risk and create individual insurance ratings based on such data. These types of data include personal data of clients to calculate risk and premium related to that risk; motor vehicle information; small-scale industry goods data; and so on.

In addition, there are specific legal requirements that govern the insurance industry.

- Assisting potential customers through a virtual assistant.

- Thousands of claims are processed, and thousands of questions are answered every day.

- Delayed and intelligent Underwriting process in the insurance industry.

Using machine learning tools, this process can be further improved. The automated process allows claims to be automatically moved from the initial report to analysis and customer contact.

Some insurance companies are already automating parts of their claim-processing, resulting in significant savings in time and improved customer service.

The use of machine learning tools enables insurance companies to detect fraud much more quickly when compared with relying solely on human analysis.

The Healthcare area is the most effective area where machine learning can be beneficial during underwriting. Healthcare insurance aims to cover medical expenses incurred due to sickness, accident, disability, or death.

Since the healthcare analytics market is growing, data-driven approaches stand to benefit this area of insurance quite a bit.

Using machine learning-based tools, they can collect insights from large volumes of highly diverse data such as insurance claims, members, providers, benefits, and medical records. Healthcare insurance businesses can use these solutions to structure and process data, resulting in cost reductions, higher quality of care, and fraud detection.

There is a wide range of business workflows that require recurring documents, such as receipts, bills, insurance quotes, and many others.

At present, processing these documents is essentially a manual endeavour, and the available automated systems are brittle and error-prone.

If a system can automatically extract all of this information, it will significantly improve the efficiency of many business workflows by eliminating error-prone manual labour.

A virtual assistant or bot can be programmed to respond to a user's question in the most appropriate way. By integrating machine learning into a chat-bot system, we will be able to achieve the desired result of customer acquisition through the proper guidance.

Case Study

Automated system for extracting information from documents and pictures

The insurance approval process needs to process a lot of documents, forms, and pictures. However, these processes can be automated using AI and Machine learning tools.

These Ai tools automatically extract data from forms, scanned documents, and pictures and update the extracted data to backend application storage systems automatically. It will reduce human interference in the process.

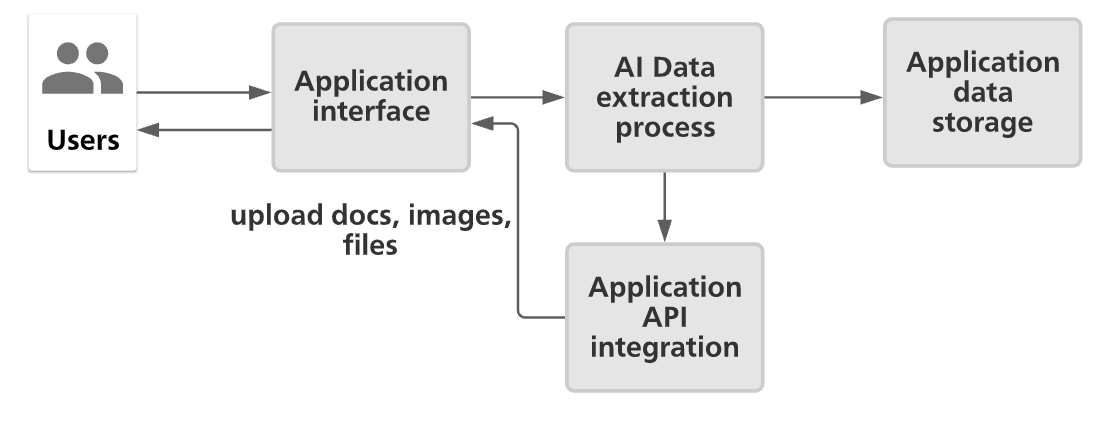

Conceptual Workflow

Users interact with either web applications or mobile applications to upload the data. The backend system uses the Machine Learning model to extract information from the user uploaded data, and it uses different models for different modalities like text, images, audio, video, etc. Extracted data loaded to the suitable storage systems for further processing.

Components and functionality

It is the endpoint where the user interacts with the application. For example, it enables the user to upload the user data.

AI Data Extraction process

In this component, specifically trained machine learning models are employed to extract the data, like text in the images, entity recognition, identification of domain-specific terms like medical and finance etc.

Application API integration

After extraction of the data, based on the requirement, it can call the internal application system to do specific tasks or again, it can use the machine learning model to make certain decisions automatically.

Application data storage

Extracted information from previous components tasks is stored in storage systems. Based on the requirement, it can be used for further analysis. These automated systems are used across the industries to improve efficiency and optimize the systems.

#arocom #artificialintelligence #machinelearning #datascience #fintech #insurance